Using Cash Flow Data to Drive Strategic Business Decisions

Christine Trumbull is a CPA and Quickbooks certified pro advisor and the founder of Pinnacle CFO Services. 28 years of experience in financial and business management have led her to her current role: ensuring seamless transitions for founders and their families.

Set yourself up for success with this free resource.

"The 10 Metrics Must-Haves to Grow Your Business, Increase Profits, and Double Your Cash Flow in 12 Months"

A trusted resource for family-owned and closely held businesses looking to take their company to higher places.

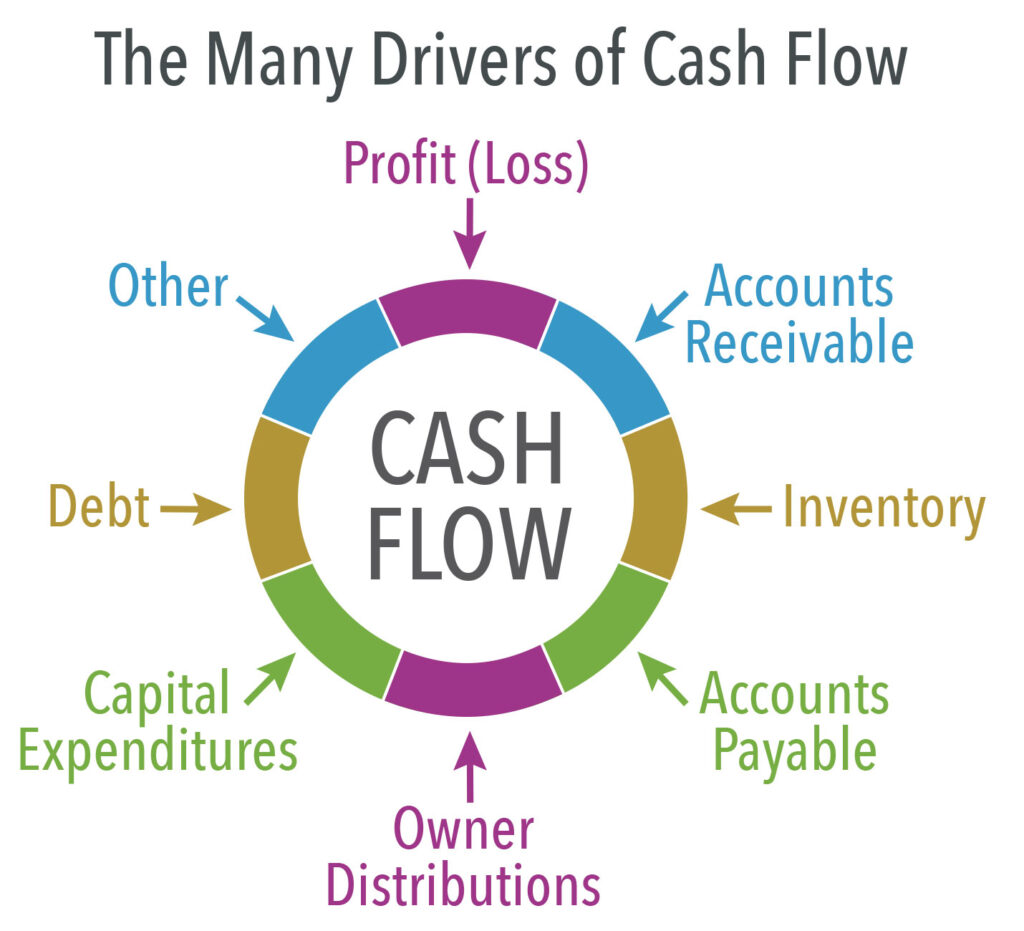

Cash flow data is a goldmine of information that can guide strategic decision-making in your business. By analyzing your cash flow, you can uncover insights that help you manage risks, allocate resources more effectively, and plan for long-term growth. In this blog, we’ll explore how to leverage your cash flow data to make smarter business decisions.

Analyzing Cash Flow Trends:

Identifying patterns in your cash flow can reveal important trends, such as seasonal fluctuations or recurring cash shortages. By understanding these trends, you can plan ahead, ensuring that your business has sufficient liquidity to navigate periods of lower cash inflows or higher expenses.

Making Informed Decisions:

Your cash flow data should be a key factor in all major business decisions, from investing in new equipment to expanding your team. For example, if your cash flow is consistently strong, it may be the right time to invest in growth initiatives. Conversely, if your cash flow is volatile, you might focus on stabilizing your finances before taking on new risks.

Managing Risks:

Effective cash flow management can help you mitigate financial risks. For instance, if your cash flow data shows a pattern of late customer payments, you can take proactive steps to tighten your credit policies or offer incentives for early payment. Similarly, if you notice rising expenses, you can explore cost-cutting measures before they impact your profitability.

Key Takeaways:

Leveraging cash flow data for strategic decision-making enables you to manage your business more effectively, reducing risks and positioning your company for long-term success. By making data-driven decisions, you can optimize your resource allocation, plan for future growth, and ensure the ongoing financial health of your business.